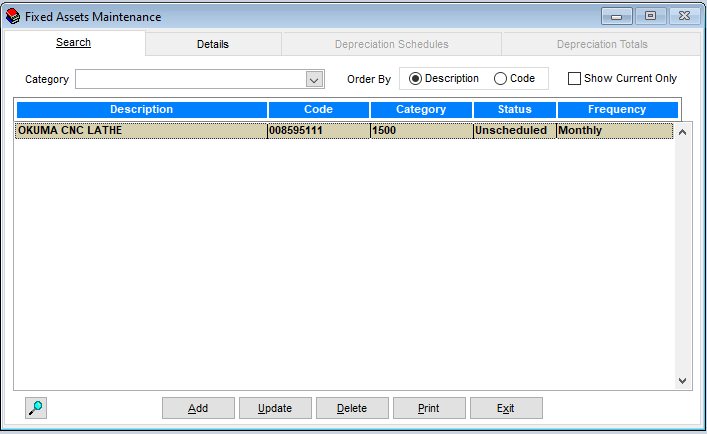

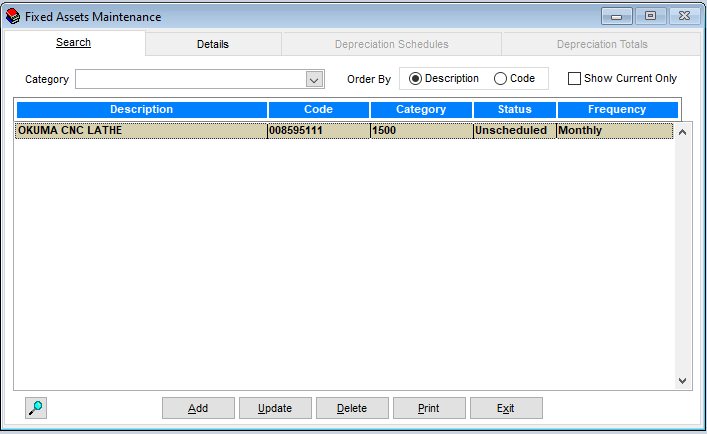

The Fixed Assets Module allows you to keep track of Fixed Asset purchases, create and maintain depreciation schedules and create depreciation journal entries.

The Fixed Assets Module allows you to keep track of Fixed Asset purchases, create and maintain depreciation schedules and create depreciation journal entries.

Schedule Type

Choice from the drop down menu: Capital Purchase, Additional Capital, Attachment or None.

Description

Short explanation that depicts the Schedule Type of purchase.

Serial I.D. Number

This is the unique alphanumeric identifier of the asset.

Model

Description of the Model of the Asset.

Date of Acquisition

Date Asset was purchased.

Depreciation Method

The type of deprecation that determines the calculation which will be used to depreciate the asset.

Useful Life of Asset

The length of measurement the Asset will be depreciated over.

Depreciation Frequency

This will default depending on the frequency you choose.

Starting

Enter the Month and Year in which the asset depreciation will be booked.

Total Cost

The specific amount of the Capital Purchase, Additional Capital or Attachment that was booked for the Asset.

Residual Value

The remaining value of the Asset after is has been full depreciated.

Depreciable Value

This is a calculated field which is determined by subtracting the Residual Value from the Total Cost.

“Your program has proven itself time after time and as our company has grown in the last 6 months (with a big help from your software) we now need 2 more seats to allow us to expand the use of your software to its full capabilities in our business. I am contacting you to let you know that you helped me very much when I purchased the first seat, thank you!”

– Connor Montgomery – TYLER TOOL AND FASTENER, Tyler, TX

We and selected third parties use cookies or similar technologies for technical purposes and, with your consent, for other purposes as specified in the cookie policy. Denying consent may make related features unavailable. You can consent to the use of such technologies by using the “Accept” button. By diregarding this notice, you continue without accepting. more information

The cookie settings on this website are set to "allow cookies" to give you the best browsing experience possible. If you continue to use this website without changing your cookie settings or you click "Accept" below then you are consenting to this.